There are a couple of differences between Bitcoin mining and Ethereum mining. These differences originate from the fact that Bitcoin and Ethereum were designed with different goals in mind and they have different purposes. Though, not everyone is able to notice the contrast between these two cryptocurrencies as easily but when you dig a bit deeper into the case, you might be able to notice the differences just fine. This is exactly what we aim to do in this article. How mining Ethereum is different from mining Bitcoin and how it affects the profitability of these two counterparts.

Understanding Bitcoin Mining

Bitcoin is a decentralized peer to peer cash system designed by Satoshi Nakamoto, the anonymous creator of the cryptocurrency that is Bitcoin. The way this protocol works is by using a math equation which adds blocks to the blockchain – which is a chain of transactions (it is similar to a list with all the transactions happening in it). Each of the abovementioned blocks consists of a hash code from the block prior to it in order to timestamp the new ones.

Every 10 minutes or so, a block gets added to the blockchain. In fact, miners compete with each other in order to solve a math equation (SHA - 256). The answer to the math problem always starts with 4 zeroes. This process needs a lot of computational power which is directly equal to electricity usage. The first miner who finds the solution to the math equation gets rewarded with 12 Bitcoins; that is without considering halving of course.

Bitcoin Mining Difficulty

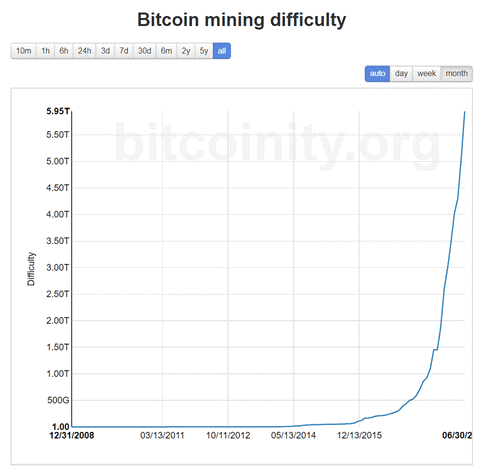

Over the last 2 years, the difficulty of Bitcoin mining has increased by a significant amount due the fact that new hash power has been added to the network. The network difficulty is adjusted in order to compensate for the increase in computational power. This way, the system makes sure the time required to successfully mine a block always stays the same and is around 10 minutes each.

In the year 2015, Bitcoin miners began to face a rise in network hash power. This was mainly due to the fact that Bitmain’s Antminer line started. Antminer used some specifically designed integrated mining chips. These chips were known as Application Specific Integrated Chips or ASIC and were a thousand times better than ordinary mining systems at figuring out the solution to the SHA – 256 algorithm that the proof of work system of Bitcoin utilizes.

All of these advancements in hardware technology have caused the network difficulty of Bitcoin to rise in the past years. Today, you may have to get your hands on an ASIC in order to be able to even compete in the world of mining. Besides that, you might want to consider joining a mining pool as it helps immensely to increase your chances of successfully mining blocks. Mining pools combine the computational power of the whole group which goes up to some extreme numbers. Once the mining pool mines a block successfully, the reward is divided among its members based on their contribution level.

Understanding Bitcoin vs. Ethereum Mining

Ethereum differs quite a lot in quite a lot of aspects. For instance, unlike Bitcoin, Ethereum is a centralized software platform. This means that Ethereum has a central office and has Vitalik Buterin as his well-known founder which in the case of Bitcoin, this is not true. Ethereum utilizes a dual account structure where in private key controlled accounts as well as the contact code ones – also known as smart contracts by many other people online – both exist.

Smart Contracts execute certain actions that are predetermined when the contact’s unique address receives some amount of cryptocurrencies. Ethereum utilized a special programming language which is unique to itself called Solidity. This language performs much better in this platform as it was designed for Ethereum. It allows for easier integration of smart contracts and is much easier to use than many other coding languages out there, Ethereum’s smart contracts, actually aid with facilitating token creation as well with the help of ERC-20 and ERC-721 protocols.

ERC-20 is the primary protocol used for creating new tokens in the crypto space while the other protocol, ERC-721, thanks to the increase of both digital and real world assets being tokenized, continues to see adoption. The major contrast between these two protocols is that tokens created by ERC-20 are fungible.

How does mining Ethereum work?

Well, the primary functions of mining Ethereum are basically the same as Bitcoin. There are nodes that compete with each other in order to complete a math problem (similar to Bitcoin). The node which is successful in adding the next block to the blockchain is going to be rewarded by about 3.5 ETH. If you remember, it would take roughly 10 minutes for each Bitcoin block to be added to the blockchain. This number has been reduced to a mere 14 – 16 seconds for Ethereum.

Ethereum uses the ethash algorithm and not Bitcoin’s SHA–256 algorithm. Both of these mining processes utilize proof of work systems which means both of these crypto currencies are going to eat through your electricity when mining since the power consumption on these two is extremely high. So, you better find some cheap electricity before you try out mining ETH or BTC.

Ethereum’s Difficulty

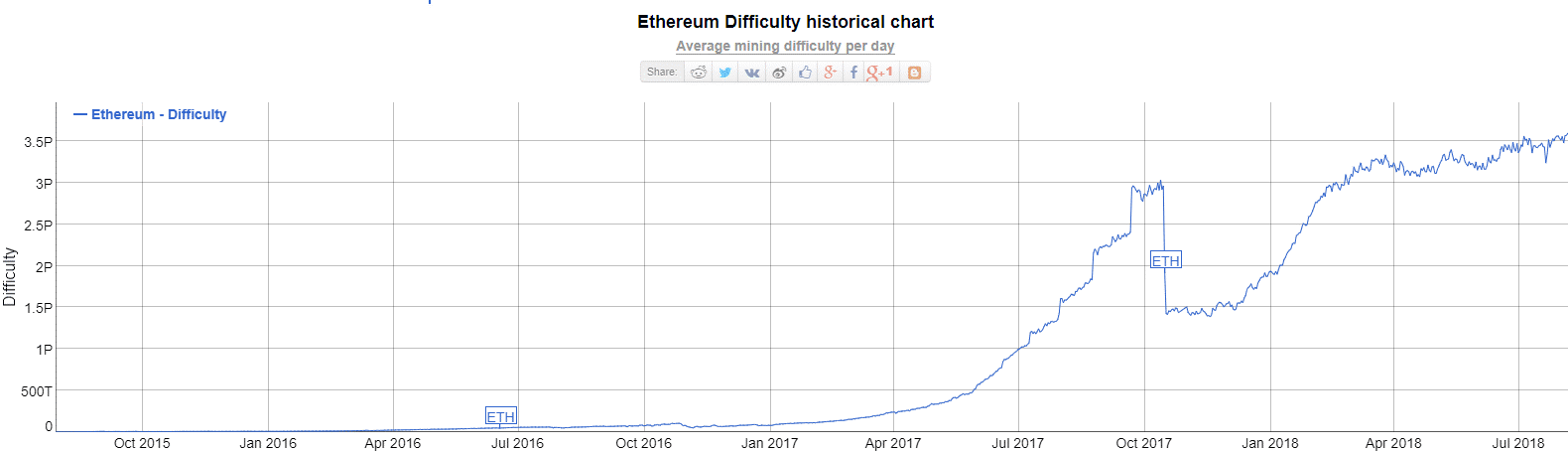

Ethereum miners also saw an increase in the cryptocurrency’s hash rate or computational power since the year 2016. Of course, this increase was nothing in comparison to what Bitcoin experienced and the numbers were way higher in the case of Bitcoin (Ethereum did not even come close to it). Unlike bitcoin, which uses mostly ASIC for mining, Ethereum is still mined via GPU miners. Of course, GPUs are far better than mining with CPUs but still when compared with the capabilities of ASIC miners, they are simply incompetent.

Ethereum vs. Bitcoin: Future Changes

Developers of Ethereum have recently announced that in the upcoming months, they are going to move away from their current proof of work type system and use proof of stake instead. The most important difference between these two systems is that the latter does not need pricey hardware and huge computational power. Instead, users are able to stake the coins already existing in their wallets on the blockchain and be rewarded based on how many coins they have staked. In simple words, it works like betting.

This change is going to be huge and is going to completely change the profitability of Ethereum. It might even cause Ethereum to pass Bitcoin in terms of popularity as mining becomes much more efficient and profitable.

Ethereum vs. Bitcoin: Profitability

It is quite hard to compare these two accurately since there are far too many factors affecting it to consider. Well, first of all, both cryptos require a lot of money at first because you need to invest in a great mining gear and start up a whole mining operation.

You should take into consideration that Bitcoin is a lot scarcer than Ethereum and This scarcity will most likely bring in significant gains in the value of Bitcoin. With that said, Ethereum has a unique role in the world of cryptocurrencies mainly due to its ERC-20 and ERC-712 protocols. The backbone of many tokens currently in the market is one of Ethereum’s two protocols. This huge dependency might result in Ethereum overtaking Bitcoin in terms of total market capitalisation in the near future.

This is another huge change since the value of Ethereum will shoot up which means all the rewards are going to be worth much, much more; hence, the profitability of mining it is also going to be a lot higher meaning investing in Ethereum might be a better move in the long run.

The Final Take

More and more miners, nowadays, are thinking that Bitcoin is mainstream; therefore, a lot of them are searching for a new challenge with not as much cost as Bitcoin. So, if you have a passion to earn some crypto coins and you believe that Bitcoin requires a huge investment right now, then it is highly suggested that you try out Ethereum. It is pretty similar in many regards to Bitcoin but much more exciting and a lot more promising.

Ethereum Mining

Bitcoin Mining

Bitcoin Mining Difficulty

SHA–256 Algorithm

Ethereum’s Difficulty

Graphic Photo World

Frontend Free Code

Code Free Tutorial

CSS Free Code

PHP Free Code

Home

Home How to use

How to use Sitemap

Sitemap About Us

About Us Suggested

Suggested Privacy Policy

Privacy Policy